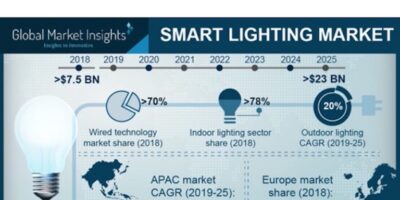

Smart Lighting Market is set to grow from its current market was valued at over USD 7.5 billion in 2018 to USD 23 billion by 2025, according to a new research report by Global Market Insights, Inc.

Rise in smart city projects and innovations in home automation are driving smart lighting market forecast significantly. The growing urban population has triggered initiatives by the government to provide access to efficient LED lights, along with deploying AI and IoT in building automation systems for commercial, residential and industrial spaces. The Ministry of Housing and Urban Affairs in India had set up a smart cities mission with a view of developing over 100 cities in the country over a span of five years.

The luminaire market will grow at a CAGR of over 16% during the projected timeline. Regulatory restrictions on the use of inefficient lighting technologies are propelling the growth of the smart lighting market. The adoption of energy-efficiency code and smart controls also acts as a major force driving the adoption of the connected luminaire market. Furthermore, the superior properties of luminaire such as durability and energy-efficiency are also accelerating their adoption across multiple lighting applications.

Wireless technology will grow significantly with a CAGR of more than 21% during the forecast period. The growth of the smart lighting market is credited to the integration of advanced technologies, such as Bluetooth, ZigBee, and Wi-Fi, into the lighting solutions. This allows lamps to be controlled through mobile apps or a home/building automation hubs and individual bulbs can be programmed to change the output as per requirements. Furthermore, the lamp’s internet connectivity makes it possible for vendors to use edge computing and equip smart bulbs with additional features such as built-in cameras, built-in speakers, and occupancy-sensing capability.

Hardware accounts for the majority share in the market. The market growth is credited to the increasing adoption of connected or smart bulbs across the globe. The proliferation of IoT devices is also serving as a major force driving the demand for the hardware market. On the other hand, the software market will grow at a CAGR of over 22% during the forecast period. The growing adoption of smart home and home automation solutions is driving market growth. Moreover, the integration of wireless technology into lighting solutions is also developing multiple new avenues for the growth of the software market.

The outdoor lighting market will grow at a CAGR of more than 21% during the projected timeline. The outdoor lighting applications are characterized by high safety & security, low maintenance cost, and adequate lighting needs while keeping the cost low. The need to address these requirements is one of the major factors augmenting the demand for smart lighting solutions in outdoor applications. The growing trend of smart cities across the globe is also driving the growth of the market.

Indoor lighting applications are dominating the smart lighting market with more than 78% of share in the revenue. The market is driven by the growing demand for energy-efficient lighting solutions among residential, commercial, and industrial facilities. The supportive government initiatives for the promotion of energy-efficient lighting along with the ban on the use of inefficient lighting solutions is augmenting the market growth. the rising trend of connected bulb and home automation systems fosters the market growth.

Europe is expected to evolve as one of the most significant revenue pockets for smart lighting market, owing to the significant number of smart city projects and increased adoption of smart LED lighting systems. The European Union innovation partnership on smart cities and communities is a program established by the European Commission that brings together small businesses, industries and cities together. The aim of the program is to enhance the urban lifestyle through sustainable solutions and addresses specific challenges across varied policy areas such as mobility, energy and transport.

The prominent vendors in the smart lighting market are Philips Lighting, Osram, GE Lighting, Cree, Schneider Electric, Echelon Corporation, Acuity Brands, Silver Spring Networks, Deako, and Tvilight.

Source: – https://www.gminsights.com/pressrelease/smart-lighting-market